Property Taxes

NOTICE:

The online payment site is unavailable every third weekend of the month from 8:00 A.M. Saturday to 5:00 P.M. Sunday Pacific Time.

Property Tax Calendar

All Taxes

-

January 1

Lien Date—the day your property’s value is assessed.

Secured Taxes

-

October

Tax bills are mailed -

November 1

First Installment is due -

December 10

Last day to pay First Installment without penalties -

February 1

Second Installment is due -

April 10

Last day to pay Second Installment without penalties -

June 30

Last day to pay current year's taxes without additional penalties

Unsecured Taxes

-

July

Tax bills are mailed and due upon receipt -

August 31

Last day to pay unsecured taxes without penalties

NOTE

- If December 10, April 10, or August 31 fall on a weekend or County of Santa Clara holiday, then the Delinquent Date is extended to the next business day.

- Please consult your tax bill for important notes regarding penalties, fees, and other ramifications of paying after the delinquent date.

IMPORTANT MESSAGES

Where My Taxes Go

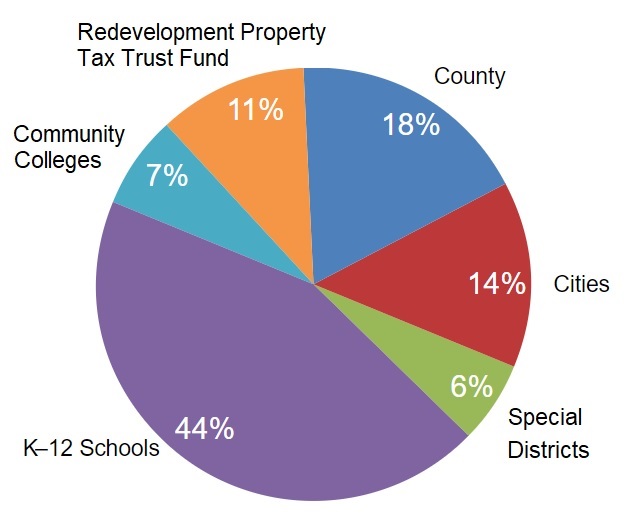

COUNTYWIDE 1% PROPERTY TAX DISTRIBUTION FY2022-23

Proposition 13 (1978) limits the property tax rate to one percent of the property’s assessed value plus the rate necessary to fund local voter-approved debt. It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction.

See information about the distribution of tax levies specific to your property.

Disaster Relief

If you’ve experienced property loss due to fire, flood, earthquake or other disaster, you may be eligible for disaster relief. The tax code defines a disaster as:

- Any misfortune or calamity that was not the fault of the property owner or the party responsible for the taxes eligible for property tax relief under Section 170 of the California Revenue and Taxation Code under certain requirements.

Click here to be taken to the Office of the Assessor's Disaster Relief page for more details.

SCC DTAC app provides convenient, secure access to property tax information and payments

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC, a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500,000 property owners with convenient access to pay their secured property tax payments. Learn more about SCC DTAC, Property Tax Payment App.

Payment Information

Payments made to the Department of Tax and Collections are typically processed within 2-5 days of receipt.

The postmark date is used to determine the timeliness of the payment based on the tax installment delinquency date.

Learn about ways to pay your property taxes.

What does the Lien Date mean on my bill?

There is a lien for taxes on each property as of January 1st. This is a statutory lien, not a recorded lien. Per California Revenue & Taxation Code 2192: Lien Date "Except as otherwise specifically provided, all tax liens attach annually as of 12:01 a.m. on the first day of January proceeding the fiscal year for which the taxes are levied".

We Would Like to Hear From You

Your feedback is important in helping us continue to build a better organization. Please take a few minutes to fill out a survey regarding your interaction with the Department of Tax and Collections - Property Taxes.